Why Life Insurance?

We are all exposed to numerous risks in our daily lives. When we think about buying a life policy we are protecting our loved ones in the event of an unexpected loss, an accident or a terminal illness. At Insurance Pro we work with multiple renowned insurance companies to warranty our clients the best prices with excellent customer service.

Many people obtain a life policy so that in the event of death they can protect their assets such as paying their mortgage, leaving a legacy to their family, replacing the loss of income or in many cases pre-paying their funeral expenses.

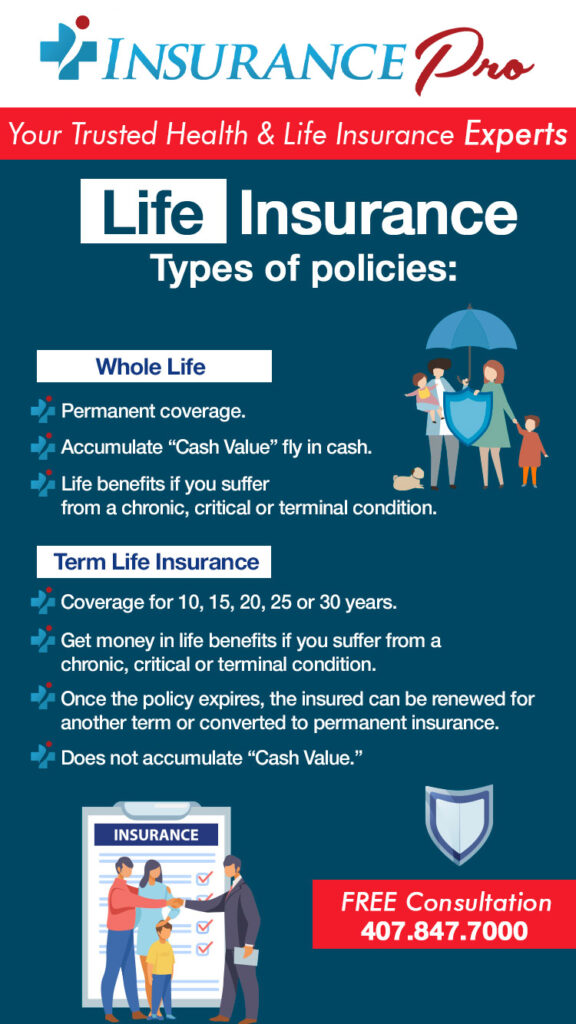

Types of policies:

Whole Life Insurance

- Permanent coverage

- Accumulate “Cash Value” fly in cash.

- You can get money in life benefits if you suffer from a chronic, critical or terminal condition.

Term Life Insurance

- Coverage for a certain time. For example at 10, 15, 20, 25 or 30 years.

- You can get money in life benefits if you suffer from a chronic, critical or terminal condition.

- Once the policy expires, it can be renewed for another term or converted to permanent Insurance.

- Does not accumulate “Cash Value”

Read also: Frequently Asked Questions on Life Insurance.

TTY 7-1-1

TTY 7-1-1