Medicare Advantage Plans work like traditional HMOs and PPOs.

You may already be familiar with these types of plans (HMOs and PPOs). Medicare Advantage, also known as Medicare Part C, makes it possible for people with Medicare Part A (hospital insurance) and Part B (medical insurance) to receive their Medicare benefits in an alternative way. Here’s what is (and isn’t):

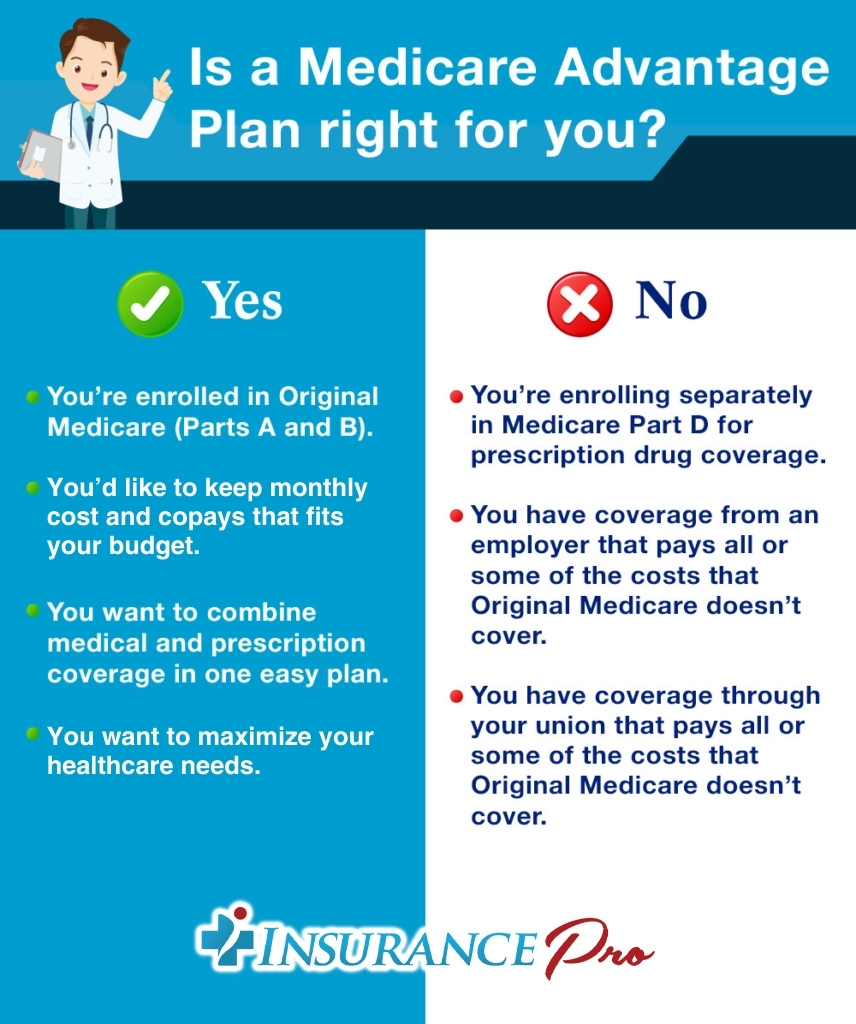

Yes

- You’re enrolled in Original Medicare (Parts A and B).

- You’d like to keep monthly cost and copays that fits your budget.

- You want to combine medical and prescription coverage in one easy plan.

- You want to maximize your healthcare needs.

No

- You’re enrolling separately in Medicare Part D for prescription drug coverage.

- You have coverage from an employer that pays all or some of the costs that Original Medicare doesn’t cover.

- You have coverage through your union that pays all or some of the costs that Original Medicare doesn’t cover.

The Pros of Medicare Advantage plans

- Medicare Advantage plans must offer at least the same level of coverage as Medicare Part A and Part B and may offer a Part D.

- Medicare Advantage plans may cost you less.

- Medicare Advantage plans coordinate care among your health care providers.

- Medicare Advantage plans can serve as your “one-stop” center for all your health and prescription drug coverage needs.

Key 2025 Medicare Advantage Trends

- According to a 2025 KFF report, 9 out of 10 Medicare Advantage enrollees are in plans that offer Part D prescription drug coverage.

- 89% of enrollees have access to supplemental benefits not available through Original Medicare.

- Lower out of pocket costs many areas, but it’s important to check plan details for deductibles, copays, and coverage limits.

Is It the Right Fit for You?

A Medicare Advantage plan might be right for you if:

✅ You’re looking for all-in-one coverage including prescriptions.

✅ You’re comfortable with using a provider network.

✅ You want to reduce out-of-pocket costs with a maximum yearly spending limit (Original Medicare does not have one).

However, you may prefer Original Medicare with a Medigap (Supplement) plan if:

🔄 You want the freedom to see any doctor or specialist nationwide who accepts Medicare.

🔄 You travel often and need flexible coverage.

🔄 You prefer predictable costs and fewer restrictions.

Do you have other questions about Medicare Advantage?

Contact us if you have questions and also to find out if a Medicare-Medicaid Plan is available in your area.

TTY 7-1-1

TTY 7-1-1