In 2021, 52 percent of Americans owned life insurance

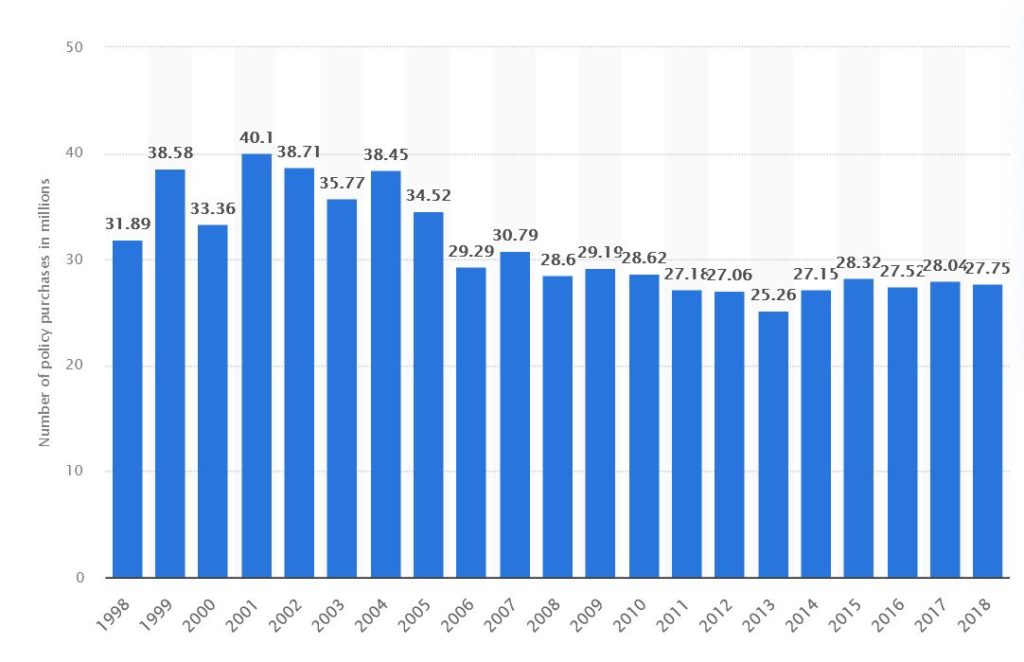

According to sources, in 2018, approximately 27.8 million life insurance policies were purchased in the United States. The average American has $178,150 in life cover. The most common age group for people to buy insurance is between 35 and 45.

Recent LIMRA research shows that 36% of Americans plan to purchase life insurance this year. When it comes Millennials, 48% say they plan to buy coverage,”said David Levenson, President and CEO, LIMRA

Reasons why Americans don’t have life insurance

There are still many Americans without life insurance for a variety reasons. Over half of those surveyed in 2019 who didn’t own life insurance said that it was too expensive. Almost one fifth of the respondents said that they didn’t think they needed it. There are also several misconceptions about life insurance among those without it, such as beneficiaries having to pay income taxes on the death benefit, which is untrue. The proceeds of life insurance aren’t taxable and don’t have to be reported to the IRS, but any interest received is taxable.

Read also: Why Life Insurance?

TTY 7-1-1

TTY 7-1-1