For the 2022 tax year, the ACA affordability threshold will decrease to 9.61%.

According to IRS Revenue Procedure 2021-36 all health plans offered by employers beginning January 1, 2022, will need to be no more than 9.61% of an employee’s household income for employer-sponsored self-only coverage to be ACA affordable.

What FPL Stand For?

Federal Poverty Level: A measure of income issued every year by the Department of Health and Human Services (HHS). Federal poverty levels are used to determine your eligibility for certain programs and benefits, including savings on Marketplace health insurance, and Medicaid and CHIP coverage.

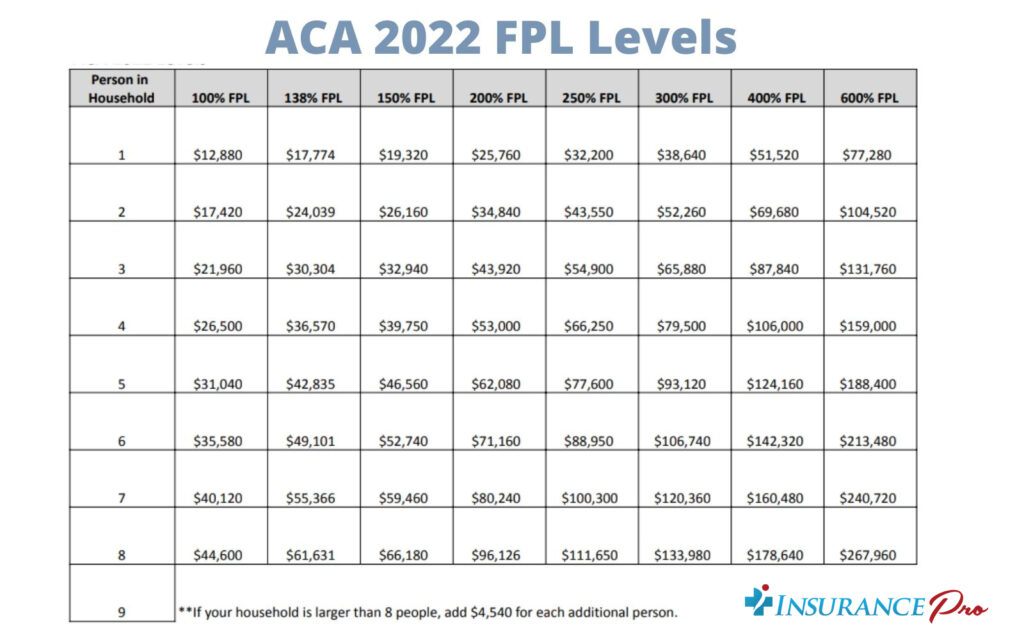

Understanding the ACA 2022 FPL Levels Table

Federal poverty levels are used to determine eligibility for reduced-cost health coverage.

- Income above 600% FPL: If your income is above 600% FPL, you probably won’t qualify for savings on a Marketplace health insurance plan, although you can still get a plan paying 100% (no subsidies that would lower your monthly premium).

- Income above 400% FPL: If your income is above 400% FPL, you may still qualify for some tax credits that lower your monthly premium for a 2022 Marketplace health insurance plan.

- Income between 100% and 400% FPL: If your income is in this range, in all states you qualify for premium tax credits that lower your monthly premium for a Marketplace health insurance plan.

- Income below 138% FPL: If your income is below 138% FPL and your state has expanded Medicaid coverage, you qualify for Medicaid based only on your income.

- Income below 100% FPL: If your income falls below 100% FPL, you probably won’t qualify for savings on a Marketplace health insurance plan or for income-based Medicaid.

“Income” above refers to “modified adjusted gross income” (MAGI). For most people, it’s the same or very similar to “adjusted gross income” (AGI). MAGI isn’t a number on your tax return.

You qualify for an incentive (dont’t recdeive a subsidy amount of money that will help to pay for you rplans)

Read also:

Contact us if you have questions about how to register during this ACA enrollment period.