Yes, you can have multiple life insurance policies in Florida, just as you can in most other states.

There is no law or regulation that restricts individuals from owning more than one life insurance policy in Florida or any other state.

In fact, having multiple life insurance policies can be a strategic financial decision for some people. Each policy can serve different purposes, such as providing coverage for specific financial needs or goals. For example, you might have one policy to cover your family’s immediate expenses in the event of your passing and another policy to provide long-term financial security for your loved ones.

When considering multiple life insurance policies, it’s essential to assess your financial situation, needs, and goals carefully,” explains Juan Carlos “JC” Doitteau.

Additionally, ensure that you can comfortably manage the premiums for all the policies you own. Before purchasing additional life insurance coverage, it’s a good idea to consult with a qualified insurance agent or financial advisor to help you understand your options and make informed decisions based on your unique circumstances. Luckily, Insurance Pro Florida can help you with this. Call Insurance Pro at 407.847.7000.

How Long Does a Life Insurance Policy Typically Last?

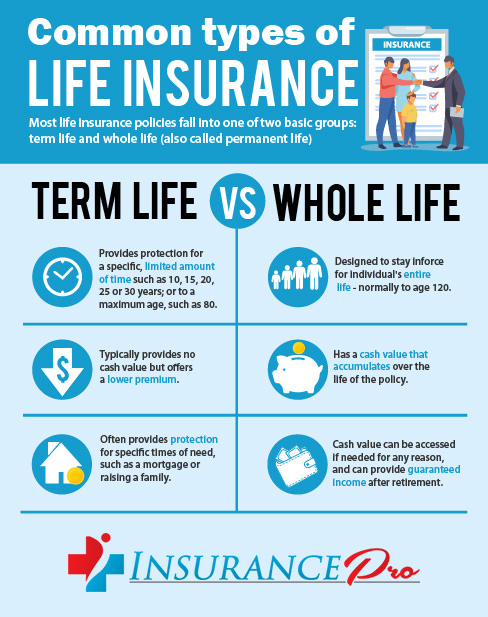

The duration of a life insurance policy can vary depending on the type of policy you choose. There are two primary categories of life insurance:

- Term Life Insurance: Term life insurance provides coverage for a specific period, typically ranging from 5 to 30 years. You select the term length when you purchase the policy. If you pass away during the policy’s term, the death benefit is paid out to your beneficiaries. However, if you outlive the term, the policy expires, and there is no payout. Some term life policies may offer the option to renew or convert to permanent insurance at the end of the term.

- Permanent Life Insurance: Permanent life insurance, as the name suggests, provides lifelong coverage. There are different types of permanent life insurance, such as whole life, universal life, and variable life. As long as you continue to pay the premiums, the policy remains in force, and the death benefit is guaranteed to be paid out whenever you pass away.

Call Insurance Pro at 407.847.7000.

Read also: