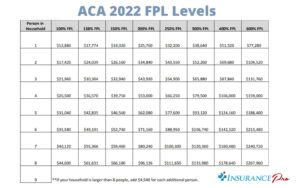

For the 2022 tax year, the ACA affordability threshold will decrease to 9.61%. According to IRS Revenue Procedure 2021-36 all health plans offered by employers beginning January 1, 2022, will need to be no more than 9.61% of an employee’s household income for employer-sponsored self-only coverage to be ACA affordable. What FPL Stand For? Federal… [Read More]